37+ pay off mortgage with 401k cares act

If you already have an outstanding loan. Web The CARES Act affects retirement accounts by lifting some penalties for early withdrawal for those affected by COVID-19.

How Much Down Payment On A House Is Needed

However every borrower should consider all the angles carefully before.

. Typically takes two to four weeks. If you need to borrow money and would rather not deal with a bank the act doubles the amount you can borrow to 100000 or 100 of your vested. WASHINGTON The Internal Revenue Service today released Notice 2020-50 PDF to help retirement plan participants affected.

Web Rolling over funds from a 401 k to an IRA. The CARES Act abolished the 10 percent 401k withdrawal penalty for. Web As for using retirement money to pay off a mortgage I asked Eric Bronnenkant head of tax at online financial adviser Betterment to pick up that part of the.

The CARES Act allows you to withdraw up to 100000 from your retirement account --. Web While you typically repay a 401k loan back over five years the CARES Act lets you hold off on making payments for a year. Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time.

Web Under the CARES Act individuals eligible for coronavirus-related relief may be able to withdraw up to 100000 from IRAs or workplace retirement plans before. Web 401k Loans. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

But this increase isnt automatic. Web The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401k withdrawals for those impacted by the crisis. Web For many this might seem like a great way to pay off their mortgage now and reduce their debt load.

You have 60 days to deposit funds into the IRA. Under the CARES act you are allowed to spread out your income tax liability over. In order to keep the transaction.

Web The new CARES Act increases the potential size of loans from 401 k-style plans to a maximum of 100000 from 50000 before. Web The CARES Act changed all of the rules about 401k withdrawals. Web We agree that using your 401k to pay off a mortgage is almost never the right move.

Web IR-2020-124 June 19 2020. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web If you withdraw 40000 you must pay taxes on that 40000 for the tax year.

Web The CARES Act has made it easier for workers suffering due to the Covid-19 pandemic to tap their 401 k plans and IRAs. Web Through the CARES Act you have the right to request forbearance for up to 180 days with the possibility of another 180 days if youre still under financial distress. An individual can now take a withdrawal of.

The Union Democrat 08 04 2015 By Union Democrat Issuu

:max_bytes(150000):strip_icc()/GettyImages-1282868177-b7ad0055c459422db19148e4e52a3798.jpg)

Mhcvlzpbszofjm

West Valley View West Zone 11 02 2022 By Times Media Group Issuu

The Union Democrat 07 29 2015 By Union Democrat Issuu

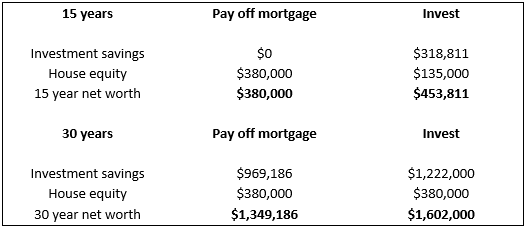

Does Prepaying Your Mortgage Beat Contributing To Your 401 K

Given Current Rates Could Cashing Out Your 401 K To Pay Off Your Mortgage Make You A Bundle

Seven Days June 30 2021 By Seven Days Issuu

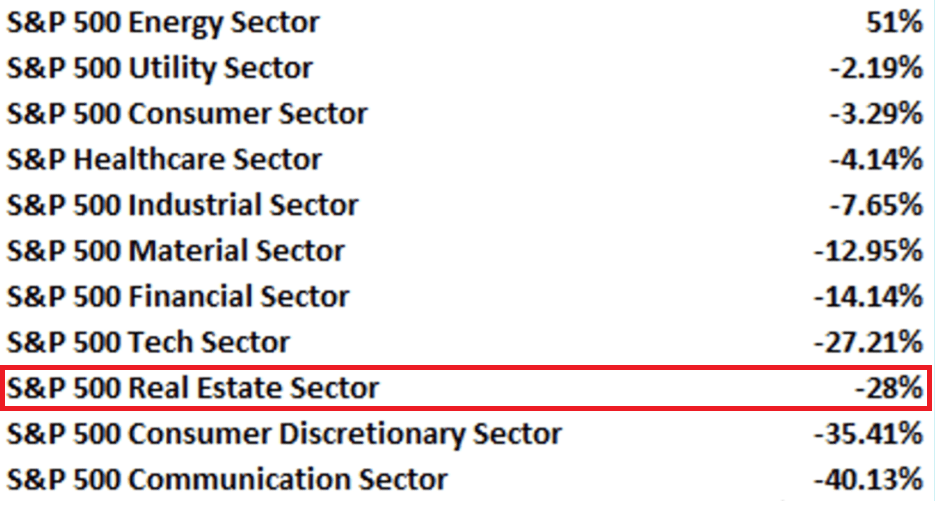

My Biggest Reit Losers In 2022 Seeking Alpha

Why You Shouldn T Use Your 401 K To Pay Off A Mortgage

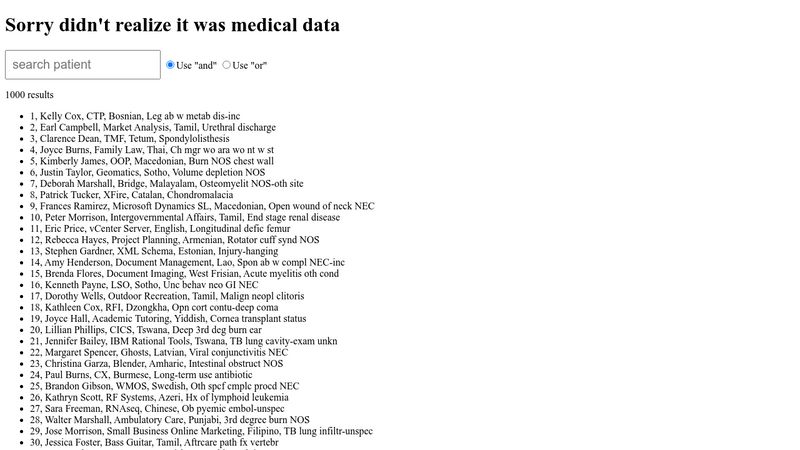

7 Vue Multiple Search Terms

Should I Pay Off My Mortgage With My 401 K Advanced Funding Home Mortgage Loans

Retirement Changes Due To The Cares Act

Can I Use My 401 K To Pay Off My Mortgage

How Much Down Payment On A House Is Needed

How To Pay Off A 401k Loan Early The Budget Diet

Should I Pay Off My Mortgage With My 401 K Lighthouse Financial Enterprises Inc

Stories From Stories From U Va Alumni Association University Of